Invoices: What you need to know

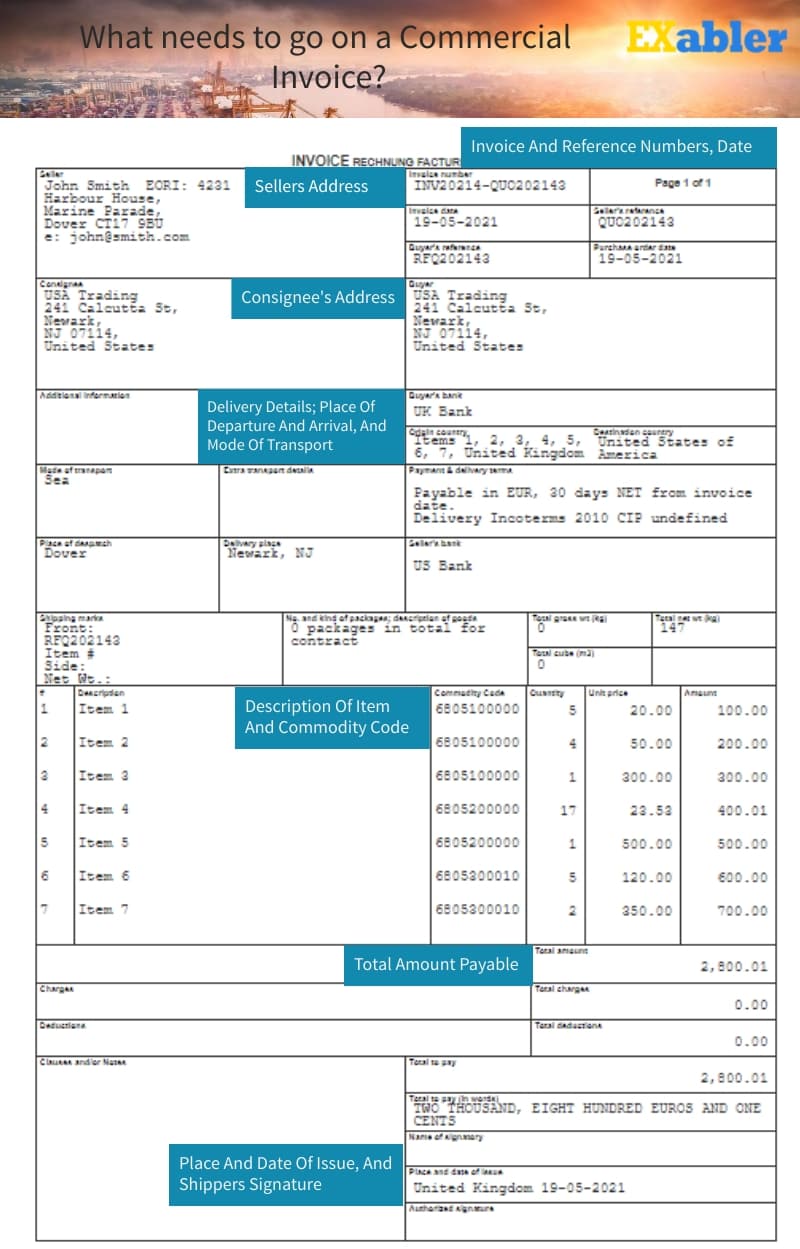

A commercial invoice is a document containing important information about the goods you intend to ship; they're also used to create a customs declaration.

What must they include?

Your invoice must include:

- Name and address of shipper (seller) including a contact person and telephone number.

- Name and address of consignee (ship to), including destination country and postcode

- Invoice date & Purchase order or invoice number

- Complete description of each item being shipped. What is the item?

- What is the item made of? What are its Commodity Codes?

- Country of origin. Where was the item manufactured?

- Number of units, unit value and total value of each item.

- Terms of Sale that define the charges included in the total value on the invoice.

- Reason for export. For example: sales, repair, inter-company.

- Declared Value for Carriage & Total value of the shipment, including currency of settlement.

- Number of packages and total weight of packages.

- Shipper's signature and date.

What happens if I do not have a Commercial Invoice or fail to fill it out accurately?

A Commercial Invoice is an obligatory document that must be created in order to import or export any goods in the UK. Inaccuracies on a commercial invoice can and will lead to errors regarding duties and taxes which could, in turn, result in delays, fines and further legal implications.

Per

https://www.gov.uk/invoicing-and-taking-payment-from-customers/invoices-what-they-must-include

https://www.ups.com/gb/en/help-center/packaging-and-supplies/export/comm-invoice.page