30 May 2023

The role of distributed ledgers in digital trade is maturing, as the CTO of one of the more mainstream bank-led consortia explains

4 April 2023

What may initially seem like the most seller-friendly terms of delivery can cause more trouble that it's worth

28 Sep 2022

The CHIEF imports switch-off presents data-driven opportunities as well as challenges for large and small businesses.

17 May 2022

The launch of the ICC Centre for Digital Trade and Innovation (C4DTI) in the UK's Tees Valley paves the way for common international standards and a digital trade system that is paperless, sustainable and secure.

3 May 2022

An interview with Professor Steve Evans, Director of Research at the Centre for Industrial Sustainability, part of Cambridge University's Institute for Manufacturing.

14 April 2022

A new free trade deal signed between the UK and New Zealand is hoped to boost trade between the two nations by 60%.

15 February 2022

A team of top negotiators is hoping to strike a range of new trade deals for the UK in 2022. Key deals include Canada, Mexico, the Gulf (GCC), and the CPTPP.

30 January 2022

The cost of net zero CO2 does not need to be high - in fact often less than 4% impact on the end consumer price according to recent research by BCG

29 December 2021

The UK will be spending £180 million to create a “smart border” that will allow agencies to share information in real-time.

5 December 2021

With full customs controls going into force from January 1 HMRC is now cracking down on businesses that have been abusing the delayed declaration scheme.

22 October 2021

We've heard the buzzwords, but what's in it for traders?

23 July 2021

Appointing a customs intermediary can be a tricky yet vital decision for many traders and business

25 June 2021

Read about the new VAT procedures affecting many e-commerce operators

3 June 2021

Find out about the codes needed to classify your goods for import and export

3 June 2021

Find the essential information needed to draft your commercial invoice

24 May 2021

They are a registered trademark of the International Chamber of Commerce. But when to use them, and which one?

16 Mar 2021

Exabler helps forwarders get more complete and timely information from shippers. Why is this important?

Postponed 6 months - announcement here (11 Mar 2021)

9 Mar 2021

Effective from 1 April, there are new rules for importing from the EU to the UK as the next step of the UK Border Operating Model. How many businesses are ready to comply?

10 Feb 2021

Don't be fooled by the Brexit myth that dominated January 2021: struggling to navigate international trade processes is not new.

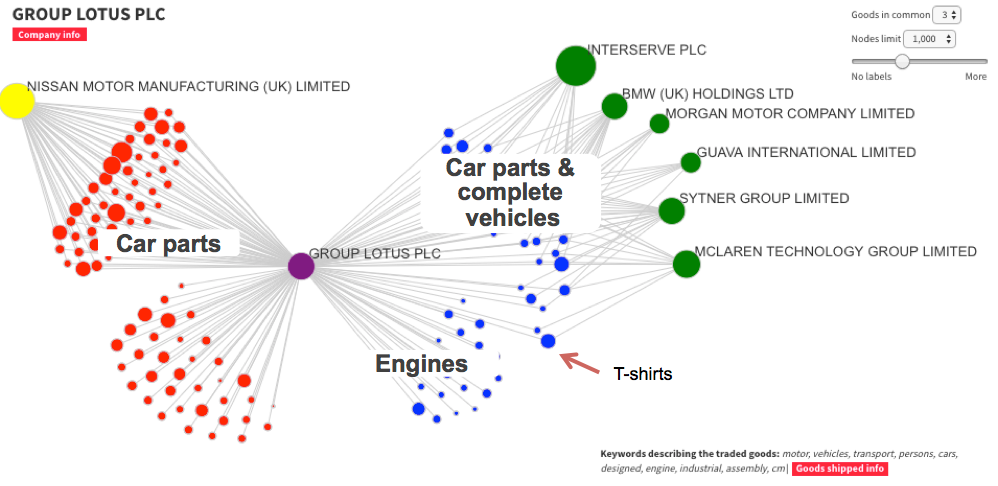

Read this guide to a tool we created to help with background checking companies and exploring your business landscape